Why Most People Lose Money

Tai Lopez

Jan 18, 2022

Misbehaving - Richard Thaler Book Of the DayWe grow up assuming the people with big titles like MBA or PHD are the smartest of all.

We are often disappointed.

Maybe it’s because life is a combination of BOTH ‘art and science’...

Making money takes BOTH book smarts and street smarts.

In today’s Book of the Day, the Nobel Prize winning economist Richard Thaler explains how classic economics is based on a false premise - that humans are rational and make non emotional choices with their money.

He says humans should not be understood as rational actors but instead as a species easily fooled into making bad, emotional choices with their money.

Thaler won a Nobel Prize by pioneering a more accurate explanation of how we behave when it comes to our bank account.

He named it “behavioral economics” which takes into account “the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals and institutions and how those decisions vary from those implied by classical economic theory.”

If you have been reading my stuff you might realize this is a lot like the “25 Cognitive Biases of the human brain” that I've been talking about for years.

Some examples of behavioral biases in our brains:

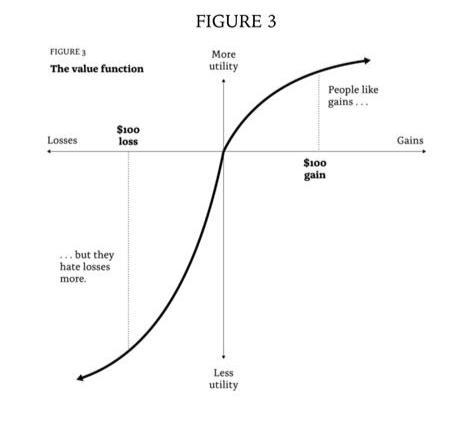

1. “Roughly speaking, losses hurt about twice as much as gains make you feel good.”

If you go to Vegas and bet $100 bucks and turn it into $10,000 early in the night and then lose half of it later, you will be depressed. Your brain is fooled and forgets that you actually made almost $5,000 in profit.

2. “Rewarding students for inputs (such as doing their homework) rather than outputs (such as their grades) is (more) effective.”

Counterintuitive isn't it? You would think rewarding your kids for getting straight A’s would be better than just rewarding them for doing homework. But you would be wrong.

3. “People think about life in terms of changes, not levels. They can be changes from the status quo or changes from what was expected, but whatever form they take, it is changes that make us happy or miserable.

Consider Jane, who makes $80,000 per year. She gets a $5,000 year-end bonus that she had not expected. How does Jane process this event? Does she calculate the change in her lifetime wealth, which is barely noticeable? No, she is more likely to think, “Wow, an extra $5,000!”

This is actually a big breakthrough that both Thaler and Daniel Kahneman discovered called “Value Theory”, humans care more about the change in their income and wealth from last year than actually how much total money they are making.

A multi billionaire who loses 90% of their wealth but still has $500 million, is less happy than someone who jumps from making $100,000 a year to $300,000.

4. Shoppers are addicted to the emotional thrill of coupons even if they realize that the retailer probably just raised the prices (which logically means the shopper isn't really saving any money).

“Several retailers (Macy’s & JC Penny’s) have tried over the years to entice customers with something called “everyday low pricing,” but these experiments usually fail.‡ Getting a great deal is more fun than saving a small and largely invisible amount on each item.”

In conclusion, what does this all mean? Don’t trust the economists you see on TV?

Maybe, but more importantly, learn to rise above your animal instincts to rise above the masses when it comes to making and spending your money.

Best of Tailopez

-

Ten Lazy Years Can Be Erased With Six Focused Months

Ten Lazy Years Can Be Erased With Six Focused Months -

Why Men's Testosterone Is Half Their Grandfather's with Ben Greenfield

Why Men's Testosterone Is Half Their Grandfather's with Ben Greenfield -

The Paradox of Wealth: Why Smarter People Aim Smaller

The Paradox of Wealth: Why Smarter People Aim Smaller -

Mamma Mia in West Adams: Tai Lopez Finds LA's Pasta Holy Grail at Cento Pasta Bar

Mamma Mia in West Adams: Tai Lopez Finds LA's Pasta Holy Grail at Cento Pasta Bar -

Sales Training, Scaling, and Breaking Objections: Tai Lopez with Johnny Mau

Sales Training, Scaling, and Breaking Objections: Tai Lopez with Johnny Mau